Renovating home can be one of the most exciting and rewarding experiences, but mistakes are easily made during the process. Therefore, it is exceedingly important that you have a thorough plan in place before getting started. In this blog, we detail 5 common mistakes to avoid when building a new home.

#1 Mistake: Putting Cost Before Quality

Cheap generally means something must be sacrificed, perhaps in the materials, the labour, or the experience of the builder. At the end of the day, if you’re building a home that’s going to last decades, you do not want to be paying for the sacrifice with never-ending repairs.

We suggest that you take a look at the ‘bigger picture’, not only the costs. Set a realistic budget, decide on the absolute maximum you’re willing to spend, and make this known to your builder. Consider the highest possible quality of materials you can afford; you want to be satisfied with the end result, in terms of appearance, as well as doing all to ensure your home will prove to be of lasting value.

#2 Mistake: Inadequate Builder Research

Unknowingly choosing an unlicensed or uninsured builder could spell out disaster for you. You need to check the reliability of the potential builders’ company; don’t be afraid to ask lots of questions because once you sign a contract, there is no going back. Look at their financial history, previous experience at renovating homes and their testimonials.

Go with a builder that is going to put your needs first, and ideally, is a Best Practice builder, aka a certified builder who strives to be distinctly ‘client-centric’ in all aspects of their work. Just as importantly, choose a builder who you can have open conversations with – they need to be able to advise you on things that could go wrong in your plan, and keep you informed at every step of the process.

#3 Mistake: Failing to Assemble Your Team from the Start

Engage the builder at the design stage!

When building your team, you need to start somewhere – architect, builder, or designer. You can either use a specialist builder who works alongside your architects and designers, or they may have an in-house design crew.

The important thing is to bring together your whole team before starting the process. This will help with budgeting and can prevent setbacks that may happen when a new team member comes on with new ideas after the already started design process.

#4 Mistake: Failing to Review Contracts Carefully

Reading over and double-checking contracts might be tedious, but it will ensure you are aware of everything that is in the paperwork. In its simplest form, a contract must cover details such as all contact details, cost projections, the actual plans, schedule, and how variations are to be managed. Minor misunderstandings or ambiguity in paperwork can result in headaches down the road, so read the fine print.

#5 Mistake: Rushing the Process

Making changes on paper is simple and less costly than changing something once construction has started, so make sure you are satisfied with the plan before going ahead. Extending or renovating your home is a big investment, so do your best to not rush into making decisions as cutting corners and rushing the process may lead to a disappointing result.

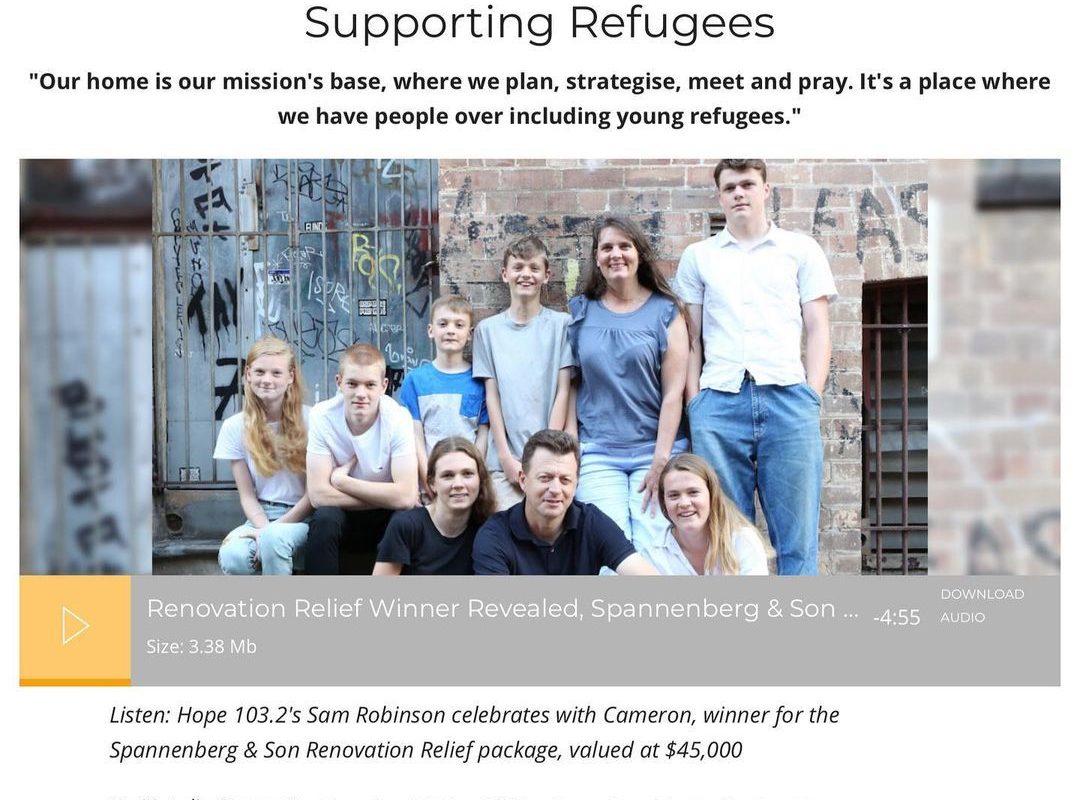

Renovate Your Home with Spannenberg & Son

Renovating or extending your home is a major project, and if not planned properly, it can become stressful and costly. Make sure you do the research, plan ahead, and trust the process. Here at Spannenberg & Son, we are your dedicated home extension and renovation specialists. Renovating homes in Sydneys south west and northern beaches since 1971, we are the trusted professionals who can help you build your dream home. Please get in touch with our team to learn more.

“If you fail to plan, you are planning to fail.” – Benjamin Franklin